Kolbe FMO

You are viewing the Kolbe A Online Result. There is an optimized version for printing available. You will find it via the icon located at the top right of the online version.

You are viewing the Kolbe A Online Result. There is an optimized version for printing available. You will find it via the icon located at the top right of the online version.

Or simply copy the link...

https://e.kolbe.com/rv/?rt=spkfmos&st=K2-74750808-323D-473C-8096-510A9A61BA80

You've taken the Kolbe A index. Your terrific natural abilities have been validated by it.

Now the Kolbe Financial MO+ program will guide you through your Personalized Paths to Financial Success.

This is not a get-rich-quick program that assures money will pour in. It is a tried-and-true method of making your instincts work for you in money matters.

Use your individualized FMO+ report to take control of your financial decisions now.

Information about your instincts, presented here mode-by-mode, can sometimes seem contradictory. That is because the differing needs of each of your four instinctive drives makes you a complex, multidimensional person. The Kolbe system unlocks the stereotypes that may have developed around one of your modes of action - and makes it clear that you have more than one way of solving problems

“Measure your wealth by the freedom you have to be yourself.”

Kathy Kolbe

Continue

Financial decisions involving debt, change, and/or risk are universal. It's your reactions to these situations that are specific to you. So rather than give you the standard how-to approach of most economic advice, this section highlights the best way for you to handle these bound-to-happen circumstances based on your specific Kolbe A result

After completing this section, you will have insight into why doing 'the right thing' is often the wrong thing for you. You will learn how to trust your personal decision making process in situations involving debt, risk, and change.

We recommend that you print this section and show it to friends, partners, and advisors to help them understand how you need to take action in order to make your best financial decisions.

Read through all the sections or jump to the one that most interests you:

Continue

Confirm specifics of any opportunity that would add to your debt. Be sure to decipher its impact on your predetermined strategies.

It is easier for you to move the bar up or down from a given level of debt than it is to go into it in the first place.

For you, Kolbe, there is a need to equate particular debt to other options for action. Translate it into its potential influence on your standard of living, without making assumptions that debt is a negative.

You need someone or something else to track your debt for you. Find advisors who will help keep your finances within a reasonable range.

Turn over as much as you can to others when it comes to following payment schedules. Use apps or software you can customize to help with this.

Unknowns are a challenge for you, not a turn-off. Your innate sense of how to deal with them comes from your need to improvise, to deal with moving targets.

Keep your options open by having ways to bail out that are as easy to trigger as are ways to get in deeper, depending upon which is to your greatest advantage.

Be sure contracts you sign and agreements you make allow you to maneuver with a sense of urgency, and without penalty.

You need to view debt as an opportunity to upgrade the quality of things that are important in your life.

Do a gut check periodically to be sure that both the type and the amount of debt you incur will help you achieve tangible goals, like buying the car, remodeling the house, or taking early retirement.

Continue

Kolbe, you may go back and forth with your internal debate over whether to take a risk, with the danger that opportunities will pass you by before you take action.

Pay close attention to the data without ignoring your own interpretation of it.

You may well read things into information that go beyond the intended message. Trust your instincts when this happens, and check it out until you are completely satisfied.

Your ability to adapt to opportunities is a part of your creative genius. You are able to keep several balls in the air at one time.

A financial plan is critical for you. It gives you the basis for risk assessment. Without it, you may be tempted to take too deep a plunge. Be sure that if you have five offers open, you can cover any and all that come through.

Partner with others and/or find advisors who monitor your level of risk, so any surprises are most likely to be to the good.

Protect at all costs your ability to act spontaneously - to either take or withdraw from risk. Insist on the freedom to act on the spur-of-the-moment.

Giving yourself permission to suddenly withdraw from a situation is as critical to your ultimate success as your jumping into it at the last moment.

You may abruptly pull out of a deal, or may shut off conversation without warning. This 'impetuousness' can cause you to limit risk taking because a specific risk means a loss of freedom to act quickly. You are right to protect yourself from such deals. Don't restrain your instincts, bet on them.

Make certain that the rewards for the risks you take are sufficiently tangible to bring you personal joy.

Some of your risks need to involve investments you can see and touch, like real estate you can personally check out, or inventory you can see on the shelf.

Other risks you take may be very abstract, and involve paper transactions. For you this type of diversified portfolio makes sense.

Continue

You need to calculate differences as they take place in your financial situation, but not down to the last penny Kolbe. Assessing the impact on your long- and short-term strategies is the main goal.

If you need to reconfigure budgets, you should document the changes so you don't have to question later what caused you to do it the way you did.

Be sure to keep your drafts and background material as well, since reviewing your own work makes you the most experienced on your own finances.

Change is a must for you. You thrive in an atmosphere in which you can switch gears frequently.

Your financial plan needs to provide maximum opportunities for change in emphasis, type of investments, or length of payments.

Look for debt you can pay back without penalty, liquid investments that you can sell to take advantage of other opportunities.

If you choose to dump an investment just because you are tired of it, don't worry that there is something wrong with your approach - it will probably work for you. Just be sure to check out the tax consequences.

No need for you to hesitate. Opportunities for change recharge your mental batteries.

You make many of your best financial decisions on the spur of the moment because your mind is set to a fast pace. If a deal doesn't come together quickly, you probably ought to pass on it.

Changes are right for you when they seem to fall into place almost spontaneously. Go ahead, take the plunge when it fits your rapid stride.

Don't let new-found wealth change what's important in your life - any more than you would let a downturn in your personal economic situation rob you of your core values. Tackle changes so they do not tie you down to having to work against your grain.

When new opportunities arise that open doors for you, judge them according to whether what's on the other side is going to improve the intrinsic quality of your life.

Continue

If haggling seems the way business is done, treat it as a customary business practice Kolbe. Observe how others get the best deals and act accordingly.

No two deals are quite alike, so don't artificially force them into a mold. Work both sides of the deal, play opportunities off one another, and use every other technique that normally works well for you - as long as it is ethical.

Shoot for the moon, Kolbe. Why not? You'll never know how good a deal you could have cut unless you try for it. Just don't 'low ball' it in a way that insults the other party. If your deal doesn't come together well at the start, the more you try to finagle a solution the less likely you are to make it work in the end.

What's the point of negotiating a deal if it doesn't buy you greater quality. Hold out for the issues that relate to your sense of quality, whether that seems as important to others or not. Otherwise you may get the right price, but not get what you need the most.

Your highly adaptive nature makes you a wonder at grabbing hold of unscheduled opportunities.

Following your instincts also may catch you just as you are on the brink of straying too far from your financial capacity. If you trust them and back out, you will be okay.

It is important for you to pay attention when you are drawn toward deviating from the plan. Try to separate your desires and ability to rationalize from your innate sense of when to spend and when to save.

'Spontaneous' describes you so well that there is no way you are going to be free to be yourself and not be an impulse buyer. That's how you get so many good deals.

If you don't take advantage of this natural talent, you will miss out on many terrific buys.

That also means you will occasionally suffer from buyer's remorse, or that sinking feeling that makes you wonder if you should have held off from making a purchase.

Remember, there can be even more remorse if you lose out on the best deals because you lost confidence in your innate ability to sense a good thing.

Continue

Kolbe, the wisest financial decisions you make are those that allow you to be true to yourself. Acting on this sense of purpose may mean going against standardized dos-and-don'ts. Here you'll find highly personalized approaches to doing what you either want to do or believe you ought to do, without giving up one iota of your freedom in the process.

Use this section to keep from capitulating or caving in on protecting your personal financial prerogatives, when you decide to:

Whether it's a wedding, bar mitzvah, or a once-in-a-lifetime fling, your nature is to go all out and figure out how to pay for it later. You have undoubtedly learned the hard way that you can not always count on that to work.

What's a resistant Follow Thru to do? Budgeting can spoil all the fun for you. It's a good bet you would ignore it eventually anyway. Paying cash works - if you have it available. Don't focus on it not being the wisest money management approach, if it saves you from getting in too deeply, operating on a cash basis makes sense.

If you don't have money 'in your pocket,' figure out how to raise it, sell something, take a second job. Concentrate on how to build your special occasion money pot - then have an absolutely wonderful time spending it (and only it) on something that matters lots to you.

People who know you well expect a certain amount of questioning if they ask to borrow money from you, or get you to co-sign on a debt. If you either go over-board with an interrogation or you don't delve into any of the background, they would be wise to assume your answer is no. Don't leave them in suspense if that's the case.

If you are seriously considering the possibility, ask permission to seek the opinion of others in a position to know as much or more than you do about the situation. Without breeching confidence, it is wise for you to be able to frame the issues with input from other people.

Whether or not you make the loan, be sure to itemize the issues involved and connect the decision with the specific points. This will help keep it a more action-oriented or business issue rather than a personal one.

If your gut doesn't tell you to either do it or not do it, take that as a 'Don't.'

Since you will do many things at one time, you'll find yourself wearing many hats - something common with entrepreneurs. There is a point, however, when you would have to let go of running the successful enterprise. When it requires concentrated effort on the single focus of managing what you created, you would need to move on.

If you choose to go the entrepreneurial route, begin immediately to build a team that includes the administrative and managerial talent you will later depend upon for consistency and reliability of operations.

Find people you can trust, who are able to grow with you, and who recognize that you count on them to do the things you won't do. Be sure they value your drive and realize the importance of freeing you to do what you do best.

Kolbe, your Initiative in Quick Start makes you an ideal customer for most life insurance experts - when you are ready to buy. Most of them share your Initiating Quick Start sense of energy. This can work well, so long as you evaluate the options from a logical point of view before jumping to an instinct-driven conclusion.

Ask for plans with the lots of options. Avoid getting locked into an irrevocable solution. Find out the cost of changing your mind.

Give your insurance advisor time-frames for revisiting your decisions, getting agreement on who will be the reminder. Resist your inclination to reconsider one aspect without looking at the entire package. It takes longer, but it is critical to do this. Forewarn your agent(s), so you can avoid penalties for exercising possible prerogatives.

Health insurance issues also revolve around your Quick Start need for making immediate decisions - and being able to adjust them later. If you should ever have physical limitations, you will find yourself relying even more on your instincts. So be aware of how your health plan impacts your ability to decide for yourself on the best course of action.

There are always trade-offs. What might be the best short-term decision could lead to regret later. Protect your need for taking urgent action by trying to avoid permission-intensive processes.

Take your time. Things may look great on the surface but have some underlying problems you may not pick up on. First, don’t buy sight unseen – if it’s an online purchase, make sure you see plenty of pictures and get several recommendations. Test-drive a car, check out the neighborhood and consult a professional service to make sure that you’re getting what you pay for.

Continue

Your Kolbe A result can be very freeing. It validates who you are and encourages you to act accordingly. Some people mistake that as permission to avoid doing anything they don't want to do, even if they know they should. Here are some tips that will come in handy no matter what your MO - and that won't let you off the hook or let you use your MO as a cop out.

These tips work for everyone, regardless of MO, because they tap into your intelligence rather than your instincts. When you have completed this section you will have some rules of the game that will keep you focused on your financial targets.

Kolbe, you can change your mind about debt as you learn more about it, which certainly can influence how you feel regarding debt. Keeping an open mind is critical.

Evaluate your options and be sure you are emotionally ready to take on debt before you take action. Then act according to your instincts.

When your instincts are contrary to advice, trust your instincts - as long as you give the advice adequate thought.

When your instincts are to back off making a financial commitment, don't get talked into making one by yourself or others.

Kolbe, you will have to experience the success that comes with trusting your instincts to gain the emotional comfort for taking on some debts.

Your best process for making buying decisions may differ from how others involved in your life make similar choices. Personal and professional partners may not react the same ways you do to special offers.

It is helpful if those affected by your approach also get their Financial MO+ Report. Compare results and communicate with each other objectively, distinguishing similarities and differences in opinions, feelings, and MOs. Decide how to deal with them constructively (Kolbe Certified Consultants™ can offer suggestions in such situations).

Continue

You might feel that it's very important to take long vacations and see the world while you're still young and able. Advice from others might be that money is better spent on a house and saving for retirement. "Jump on these stocks before it's too late!" cries your spouse, while your gut tells you that college tuition for your two children shouldn't be entrusted to the Nasdaq.

Just as Financial MOs vary from person to person, so too do financial goals. As with the actions we take, our desires can be a source of major stress in our relationships and personal lives.

What are your financial goals? What financial decisions have you made in the past? These are the questions you will answer for yourself in this section. In the process you will be able to identify what matters most to you. Then, using what you've learned about your MO, you will be able to use your instincts to convert your desires into reality.

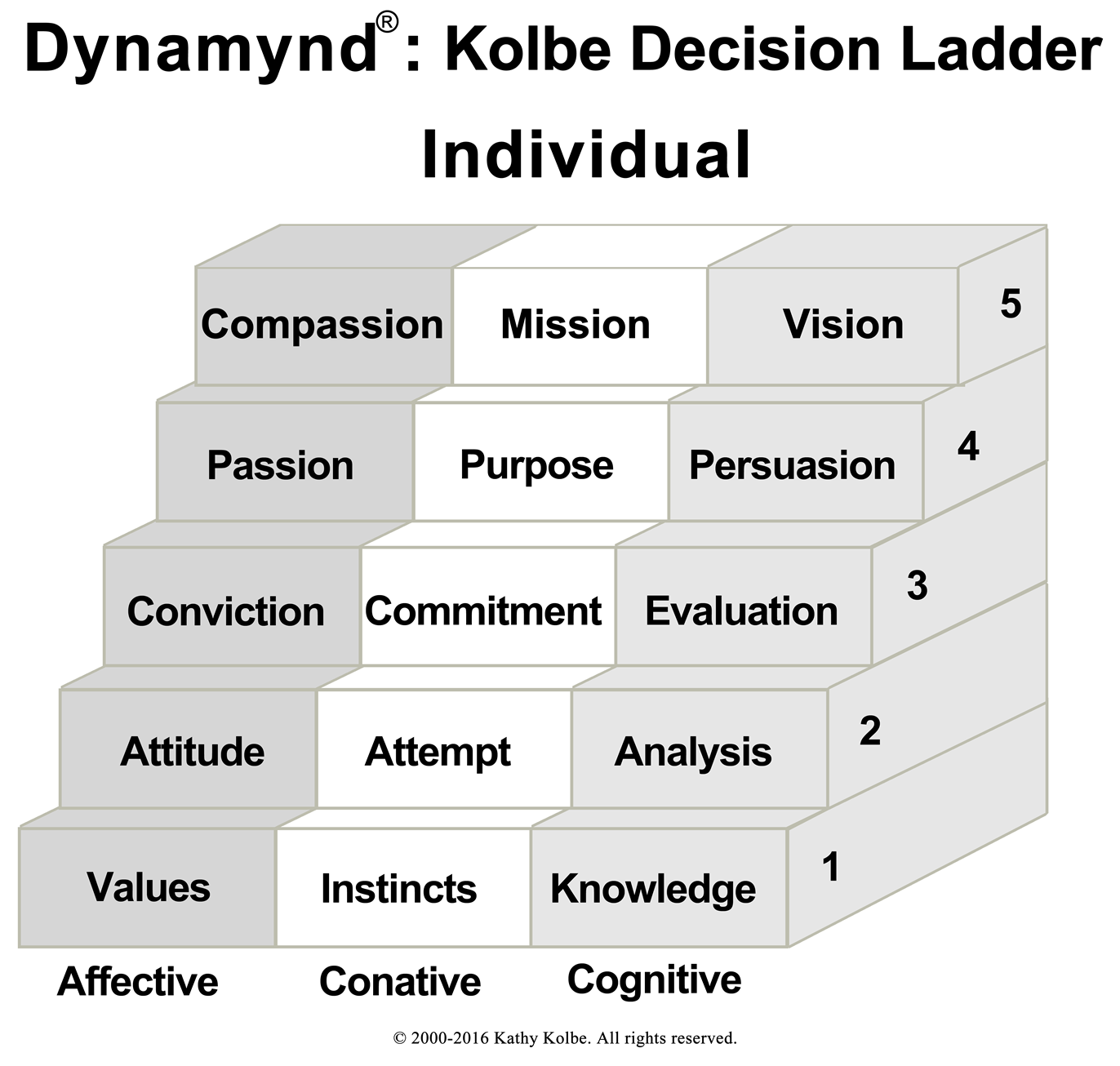

Your Financial MO+ focuses on the three levels of effort which are essential for quality economic decisions.

Assure your use of your total mental abilities when tackling risk-related issues. You will be incorporating thought, feelings and instinct-based actions for increasingly higher levels of decision making.

Begin by asking yourself what you want that would make you act on your MO and take economic risks.

List in the spaces on the right the personal financial goals that require you to assume some degree of risk. You can be as specific as an antique grandfather clock, or as broad as early retirement.

Add the thinking dimension by putting together a basic financial statement, listing all of your assets and your liabilities. If you have already done this, review it to insure that it is current.

List the decisions you intend to make within a specific time frame in order to accomplish your financial goals. This is where your instincts begin to kick in.

Consider how strong your attitude is concerning each item on your list. Go back to your list of financial goals and mark your degree of desire to try each option. Use a scale of 1-5, with 5 representing the greatest desire.

Now step it up a notch and analyze your top-priority goals in terms of their potential impact on your financial statement.

Highlight any items on your financial goals list that may involve others (such as a spouse or investment partners). Also, estimate the length of time that might lapse between taking the risks and reaching the goals and potential rewards.

Analyze each preference in terms of the amount of risk it would take. Be sure to consider opportunity costs such as other investments and the cost of your time. If the numbers don't add up, there is little point in putting more energy into the decision.

Whether the obstacles are in your own mind, the economic environment, or coming via objections from others, your attempts to remove them will indicate you are making progress. Make note of the actions you need to take and initiate necessary efforts.

Do you have the courage of your convictions? A conviction to provide security, for instance, could lead to passing up once-in-a-lifetime investment deals. It could be splurging on a dream vacation, even though that would mean spending a good amount of your savings.

Move a rung higher on The Dynamynd® decision ladder, and circle those items on your preferred risk list for which you would make sacrifices.

Just how much risk will you have to take on to achieve the goals you have singled out? Are you convinced that you can handle the worst-case scenario? What if you bought a house with a variable-rate mortgage and the rates increased dramatically? Assess both the upside potential and the downside risks you are considering.

Evaluate methods of improving the odds of success for each, such as getting a cap on increases for a variable-rate mortgage.

Then rank the sensibleness of the goals you have defined in the context of what you have to risk to achieve them.

In the mortgage example, you might rank a fixed rate as a more sensible option, when rates are relatively low, and whether that is one arena in which you just don't want as much risk.

How determined are you to act on your convictions? Enough to carve out the time, money and opportunities to make them happen?

Up to now, this decision-making process has given you 'wiggle room.' You haven't had to make a promise or give a guarantee. This is the 'put-your-money-where-your-mouth-is' point."

You have reached the commitment level when, having picked the car you want and selected all the options, you write the check or sign the credit application.

You have also reached the commitment level when, after attempting to negotiate for your price without achieving it, you resolutely walk away.

You have now experienced the use of the first part of the robust Dynamynd® decision ladder, a Kolbe Corp training tool.

Completing the following activities will fully engage you in the problem solving process in dealing with change.

Consider any changes you think you need to make in your financial picture.

Examples could be to diversify, reduce certain types of exposure, consolidate debt, alter formulas, modify a strategy.

Now, go back and underline the changes you have listed which you think you can control, or cause to happen. Indicate when you will make these changes.

Evaluate the differences between those changes over which you have control and the ones you doubt you can influence.

What factors do you find determine your level of control over the changes you have decided are important?

Would you prefer not to make many changes in your money matters right now? Is a sense of permanence more important to you than switching gears, even if the changes might mean a possibility of increasing your wealth?

Stability and consistency can be a desire, even when your MO drives toward change. If you find you want to increase your wealth, but constitutionally just won't take the actions necessary to make that happen, you are not alone.

What values do you have that may be inconsistent with your innate way of dealing with change or your MO?

Are there things you do instinctively that cause financial change for others around you? Your family? Employees? Investors? Advisors? Creditors?

Guilt regarding money often comes when changes you make are in conflict with those you think you should have made, and it is especially strong if there is a negative impact on people you care about.

Which of the situations you have listed have caused you guilt? Figure out the difference between what you did and what you think you should have done. Do you think you would do it differently in the future?